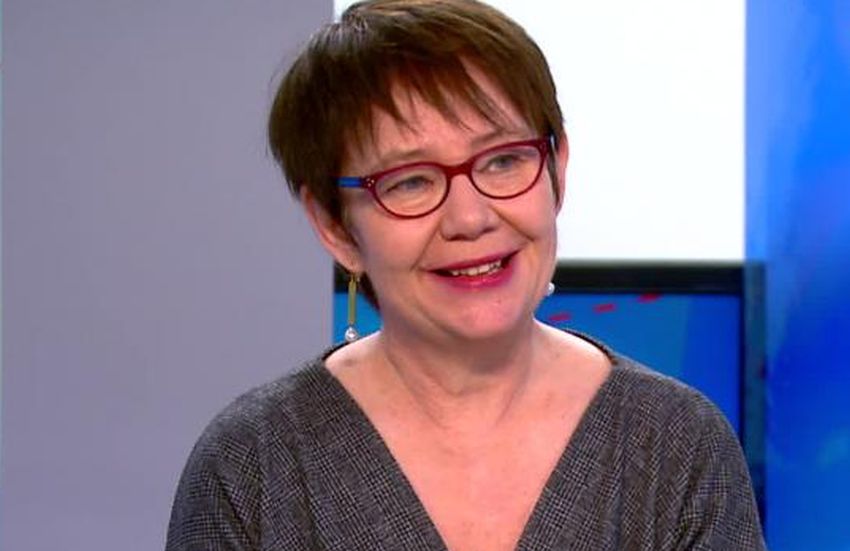

The European Bank for Reconstruction and Development (EBRD) aims to fully align its activities with the goals of the Paris Agreement on climate change mitigation, adaptation and finance within the next 20 months. “Our proposal is that by the beginning of 2023, everything we do will be aligned with the Paris Agreement,” EBRD President Odile Renaud-Basso said today in a keynote speech marking the 30th anniversary of the Bank’s establishment. She said the EBRD management would work with the Board of Directors in the coming weeks to prepare a resolution to put before the Board of Governors at the Bank’s 2021 Annual Meeting (28 June-2 July).

“This would be a landmark step in our approach, and we will further support all the economies in which we invest in their low-carbon transition,” the President said.

Under its current strategy, the EBRD has committed to dedicating most of its investments to support the transition to a green economy by 2025. Alignment with the Paris Agreement would commit the Bank to only making investments consistent with the goals of the 2030 Agenda, namely, holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit that increase to 1.5°C. “We are putting our full weight behind the net zero transition”, President Renaud-Basso emphasised.

She also underscored that combatting climate change was both an urgent and long-term effort, with different solutions required for each country. “Thirty years ago, our countries of operations faced the challenge of transitioning from a command economy to a market economy. In the coming 30 years, they face the huge challenge of transitioning from an economic model overwhelmingly reliant on hydrocarbons to one of net zero emissions. We recognise that each country will have a different path in that transition, but our goal is to support them every step of the way.”

One of the major challenges for governments today is to raise the amount of money going to climate finance from billions to the trillions the low-carbon transition requires. The EBRD’s focus on mobilising the private sector gives the Bank a unique role to play in making this happen. “The Bank’s founding premise is that well-regulated markets can unlock the scale and ingenuity of the private sector to solve our biggest problems,” the President stressed.

Support for the private sector was one of the founding principles of the EBRD when it was established 30 years ago today to “foster the transition towards open market-oriented economies and to promote private and entrepreneurial initiative”, as stated in Article I of the Agreement Establishing the Bank.

When the EBRD began its work, it invested in 8 countries in central and eastern Europe and had 48 shareholders around the world. Today, the Bank invests in 38 economies in central, eastern and south-eastern Europe, the southern and eastern Mediterranean, central Asia and the Caucasus and has 71 global shareholders. “Our character is both multilateral and strongly European,” the President said. In the coming weeks, the EBRD expects to pass the €150 billion investment mark.

The most urgent crisis now is overcoming the coronavirus pandemic and securing the recovery. The EBRD invested a record €11 billion in 2020 in response to the crisis and will continue to stand by its clients and the economies where it invests. The Bank will continue to address the urgent needs of businesses, support a strong and sustainable recovery and help its countries of operations and clients to build back better. “The EBRD must continue to help shape the destiny of its regions”, President Renaud-Basso stressed.

COMMENTS