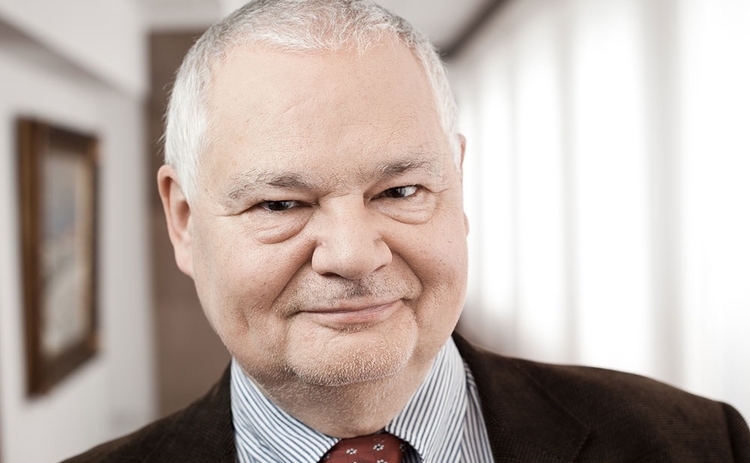

The key takeaways from Chairman Glapiński’s latest news conference were largely unchanged from his previous speech and closely mirrors the latest Monetary Policy Council statement. A flat rate scenario till the end of MPC term is unchallenged, related ING analists.

The governor considers CPI temporarily breaching above 3.5% year-on-year as likely. According to Galpiński, the acceleration of inflation is the result of external factors such as global fuel prices, increases in the price of garbage collection, the EU’s energy policy, or a temporary disruption in the supply network.

Glapiński underlines a significant output gap still persists, as the third wave of the pandemic and related restrictions had a significant impact on the economy. Glapiński expects rates to remain flat till the end of his term, but leaves door open for additional easing if needed. This closely mirrors the latest post-meeting MPC statement.

The Governor stated that globally central banks were signaling accommodative monetary policy, despite the expected rise in prices. In his view, monetary decisions of small countries in the region are not of importance for the policy of the National Bank of Poland. What is important for the NBP are the policies of the Fed and ECB.

Glapinski stated that the NBP should follow an accommodative monetary policy of the global banks until Poland enters a sustained path of growth. The prerequisite for this are: a revival in investment, a sustained improvement on the labour market and a steady rebound in consumption.

A new element is that Glapiński expects CPI to return to target (2.5% YoY) next year. While we see this as likely, it might only happen in 4Q22, mostly on base effects. GDP growth in 2021-22 should largely rely on consumption, while a recovery in investments (particularly private) is delayed. In tandem with a strong labour market and external price pressures it should keep average CPI in 2022 around 3.4% YoY.

Glapiński’s remarks confirm our scenario of unchanged rates till the end of his term in 2022. This should be accompanied with further bond purchases. The Governor also states that the NBP will be more active in determining bond yields. In his opinion rising yields may weaken the current policy of the NBP. We also don’t exclude the MPC keeping the policy unchanged for even longer, as investment recovery in this cycle should be delayed.

MPC chairman’s statement on the zloty was relatively vague. Glapiński stated that the PLN exchange rate is within the comfort zone. The central bank may take further action in periods of excessive volatility and will not defend any particular level. Currently Glapinski sees no need for a FX intervention. There were no remarks concerning the NBP’s role in the potential settlement and conversion of FX mortgages into PLN.

During the news conference the Governor publicly announced that the profit of the NBP in 2020 amounted to PLN9.3bn of which 95% will be transferred to the budget decreasing the gross borrowing needs in 2021.

COMMENTS